About Us

About Mark to Market

We are a group of investors who have always found some flaw with how our brokers report historical data in our brokerage accounts.

Some of us have had gripes over delisted securities, some of us with the disjointed approach to showing P&L but not including dividends, and others to the fact that it’s not possible to mark to market.

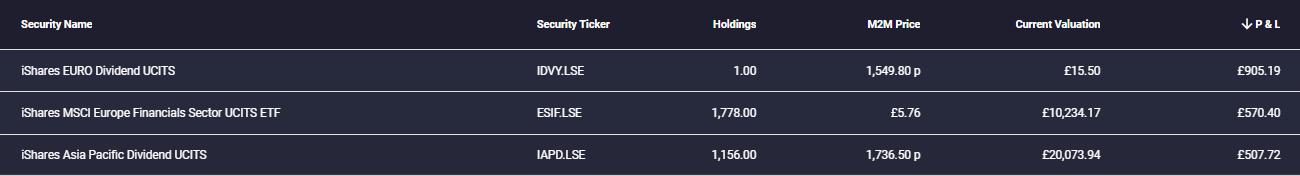

Mark to Market pricing allows users to see “what if” the price was higher, or lower, and the respective P&L for that position, and for the portfolio as a whole.

None of these are rocket science, but most brokers have no interest in making code changes for the small investor. So, spreadsheets are often the only solution. Regrettably, this doesn’t work well for all users as they hold securities that can’t be priced as the spreadsheet provider (Google or Microsoft) don’t have an extensive database of “all” securities. Whilst no provider can cover all securities, our database currently covers 146,228.